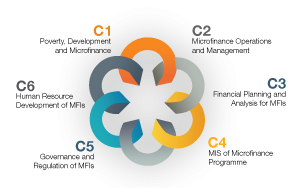

The Diploma in Microfinance is one of the flagship programmes that InM offers for knowledge creation, dissemination and capacity building of the microfinance sector. InM is the pioneer in offering this Diploma Programme in Bangladesh. The programme adopts a longer term human resource development approach where the participants get the theoretical understanding and practical experience on microfinance dynamics through classroom sessions, hands-on trainings and field exposures.

| C1: poverty , Development and Microfinance | |

|

The course covers dynamics of poverty, development and microfinance. Through this course, the participants will be able to explain different aspects of poverty and development issues. They will also be able to identify evolution and practices of microfinance in Bangladesh as well as in different countries vis-à-vis the impacts on socio-economic emancipation. The participants would also visualise the scopes and challenges of microfinance and understand the basic research agenda in microfinance. |

| C2: Microfinance Operations and Management | |

|

The course provides a holistic overview on management of microfinance operations. Through this course, the participants will develop capacity to explain historical context, issues and challenges and future directions of sustainable and inclusive microfinance programme in Bangladesh. The participants will be able to design and organise microfinance programme and services successfully for different market segments. They would be able to monitor and supervise the microfinance programme with effective tools and understand the comprehensive risk management strategies appropriate for their organisations. |

| C3: Financial Planning and Analysis for MFIs | |

|

The course acquaints the participants with the concepts, principles, techniques and process of financial and managerial accounting applicable to the activities and operation of MFIs. It provides the techniques of analysing and managing financial performance through ratios commonly used in microfinance. The participants will have a thorough understanding and capacity to interpret financial statements prepared by MFIs. They would also be able to analyse the performance of MFIs from the financial and social perspectives. The course also enables the participants to understand financial accounting process, evaluate financial statements of MFIs and use managerial accounting techniques in decision making. |

| C4: MIS of Microfinance Programme | |

|

The course provides an overall understanding of MIS of Microfinance Programme. The participants will understand the basics of MIS and computing. They would be albe to prepare, analyse and use MIS reports in management decision making. The participants will be able to select appropriate MIS software for their MFIs and will have the knowhow and techniques of report generation with these software programmes. They will also have an understanding of future ICT based financial operations. |

| C5: Governance and Regulations of MFI | |

|

The course covers regulatory and governance perspectives of MFIs. The course will increase the level of understanding of the participants relating to the role of regulatory authorities and supervisory measures in streamlining the activities and performance of MFIs. The course focuses on the role of MRA in guiding microfinance programme, key variables for microfinance regulation, government policy and legal framework regarding microfinance in Bangladesh. The participants will be able to explain appropriate governance structure and role of different governing bodies. They will gain ability to identify internal control enabling elements in an MFI and explain monitoring and supervisory compliances. Participants will be acquainted with the evolution of regulations in Bangladesh and regulatory practices in different countries. They will also be able to understand and explain the MRA rules and regulation for MFIs in Bangladesh. |

| C6: Human Resources Development of MFIs | |

|

The course provides an overall understanding and skills of managing human resources of MFIs. The participants will be able to identify functions of HRM and personnel management system. They will gain the capacity to manage overall human resources of the organisation and organise effective capacity development programmes for the employees. |

| Field Placement and Term paper | |

| Participants will prepare a term paper of 3 credits on a topic mutually decided by the participant and the instructor as a part of the diploma programme . The topic of the term paper would be selected focusing on the thematic areas of the certificate courses. |

| Academic Year and Quarters | Diploma Fees | ||

| Quarter | Duration | No. of Weeks | The total fee for the Programme is BDT 48,000 which covers all educational expenses including course material and hand outs. (The fees may be changed by the InM Governing Body with due notifications). |

| Winter | January –March | 12 | |

| Spring | April –June | 12 | |

| Summer | July –September | 12 | |

| Fall | October -December | 12 | |

|

Admission Requirements

Candidate seeking admission should apply in the prescribed form available in the InM website.

|

Diploma Requirements The minimum requirements for the Diploma are as follows:

Programme Duration The participants can generally complete the Diploma Programme in 6 (six) months; but must complete within 2 (two) years from the starting date of his/her programme. After the period, the validity of his/her enrolment in the programme will expire and s/he will have to apply for readmission.

|